Top-rated Bankruptcy Attorney Tulsa Ok Fundamentals Explained

Table of ContentsUnknown Facts About Tulsa Ok Bankruptcy AttorneyExcitement About Chapter 7 Vs Chapter 13 BankruptcyThe Single Strategy To Use For Chapter 7 Vs Chapter 13 BankruptcyThe Single Strategy To Use For Tulsa Ok Bankruptcy SpecialistTulsa Debt Relief Attorney Can Be Fun For Anyone

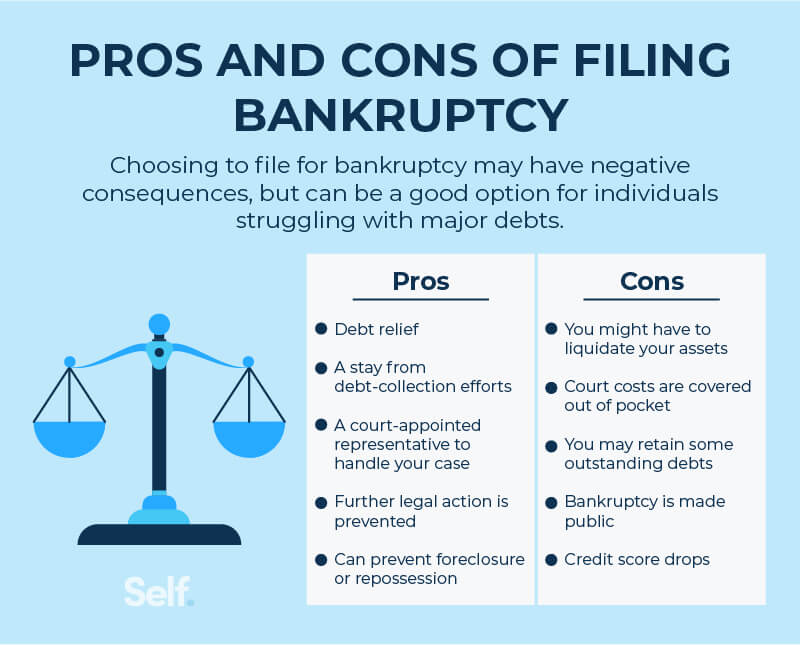

The stats for the other primary type, Phase 13, are also worse for pro se filers. (We break down the distinctions between both enters deepness listed below.) Suffice it to say, talk to an attorney or more near you that's experienced with personal bankruptcy law. Below are a couple of resources to locate them: It's reasonable that you could be reluctant to pay for a lawyer when you're currently under considerable financial pressure.Numerous attorneys also provide totally free appointments or email Q&A s. Make use of that. (The non-profit app Upsolve can aid you discover totally free assessments, resources and legal aid at no cost.) Ask if personal bankruptcy is indeed the appropriate choice for your circumstance and whether they think you'll qualify. Before you pay to submit insolvency kinds and blemish your credit record for up to one decade, inspect to see if you have any kind of sensible options like financial debt settlement or charitable credit therapy.

Advertisements by Cash. We might be made up if you click this ad. Ad Currently that you have actually decided personal bankruptcy is certainly the right strategy and you hopefully removed it with a lawyer you'll require to get started on the documentation. Prior to you dive into all the official bankruptcy types, you must obtain your own records in order.

Chapter 7 - Bankruptcy Basics - Questions

Later on down the line, you'll in fact require to prove that by divulging all type of details about your monetary affairs. Here's a basic listing of what you'll require when driving in advance: Recognizing documents like your motorist's license and Social Safety and security card Tax returns (up to the previous 4 years) Proof of earnings (pay stubs, W-2s, self-employed incomes, earnings from assets along with any type of earnings from federal government benefits) Financial institution statements and/or pension declarations Evidence of worth of your properties, such as automobile and realty valuation.

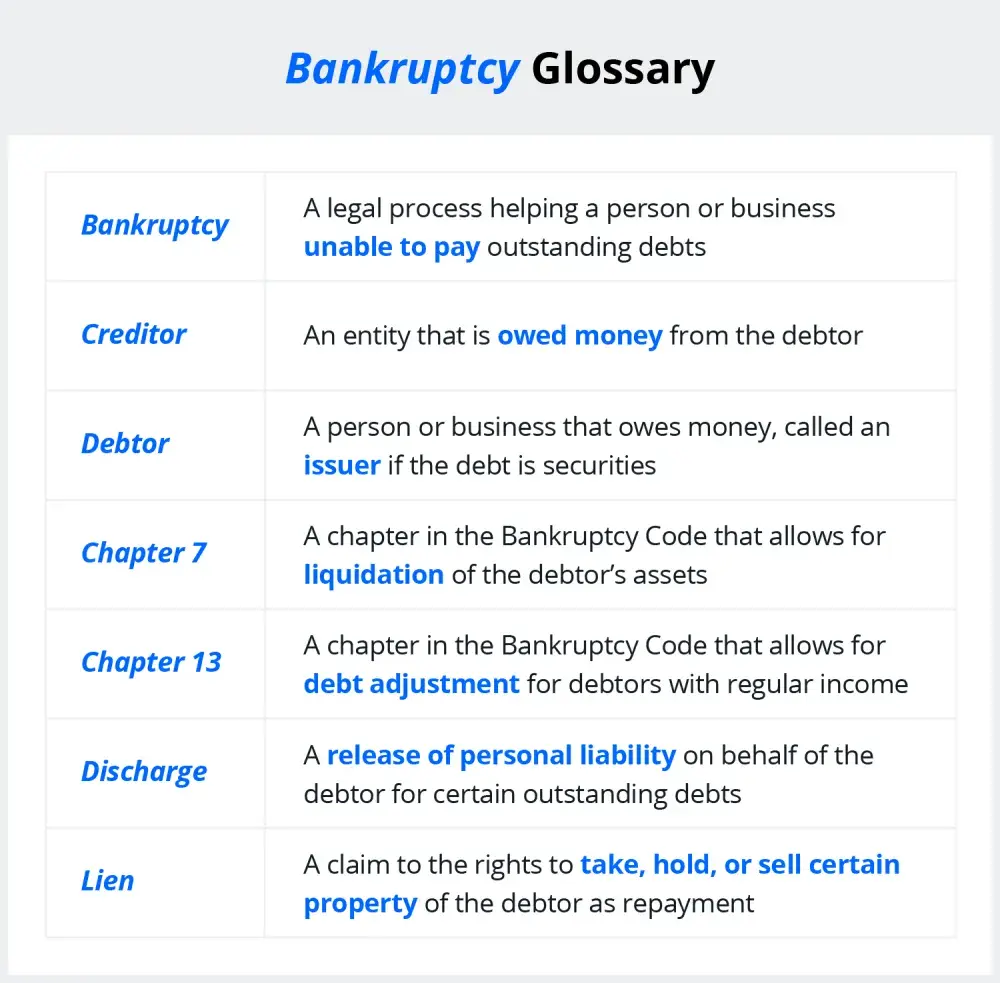

You'll desire to understand what kind of financial debt you're trying to fix.

You'll desire to understand what kind of financial debt you're trying to fix.If your earnings is expensive, you have an additional option: Phase 13. This option takes longer to fix your financial debts due to the fact that it requires a long-lasting repayment strategy usually 3 to 5 years prior to several of your continuing to be financial obligations are cleaned away. The declaring procedure is likewise a whole lot more complex than Chapter 7.

How Best Bankruptcy Attorney Tulsa can Save You Time, Stress, and Money.

A Phase 7 personal bankruptcy remains on your credit history report for ten years, whereas a Chapter 13 personal bankruptcy drops off after 7. Both have lasting effects on your credit rating, and any type of brand-new debt you secure will likely include higher rate of interest. Before you send your bankruptcy types, you have to initially finish a necessary course from a debt counseling company that has been approved by the Division of Justice (with the remarkable exemption of filers in Alabama or North Carolina).

The program can be finished online, in individual or over the phone. You must complete the course within 180 days of declaring for bankruptcy.

Get This Report on Tulsa Bankruptcy Lawyer

Inspect that you're filing with the proper one based on where you live. If your long-term residence has actually moved within 180 days of filling up, you ought to submit in the area where you lived the better section of that 180-day period.

You will need to provide a prompt list of what qualifies as an exemption. Exemptions might put on non-luxury, main lorries; necessary home products; and home equity (though these exemptions policies can differ widely by state). Any type of residential or commercial property outside the checklist of exceptions is thought about nonexempt, and if you do not provide any type of listing, then all your building is taken into consideration nonexempt, i.e.

You will need to provide a prompt list of what qualifies as an exemption. Exemptions might put on non-luxury, main lorries; necessary home products; and home equity (though these exemptions policies can differ widely by state). Any type of residential or commercial property outside the checklist of exceptions is thought about nonexempt, and if you do not provide any type of listing, then all your building is taken into consideration nonexempt, i.e.The trustee would not offer your sports vehicle to quickly pay off the creditor. Rather, you would certainly pay your financial institutions that quantity over the program of your repayment plan. A common false impression with bankruptcy is that when you submit, you can quit paying your financial obligations. While insolvency can aid you wipe out much of your unprotected debts, such as overdue medical expenses or individual loans, you'll intend to maintain paying your month-to-month settlements for safe debts if you intend to keep the building.

Unknown Facts About Top Tulsa Bankruptcy Lawyers

If you're at danger of repossession and have exhausted all other financial-relief choices, then submitting for Chapter 13 might postpone the foreclosure and assist in saving your bankruptcy lawyer Tulsa home. Inevitably, you will certainly still need the earnings to continue making future home mortgage repayments, in addition to repaying any kind of late payments throughout your layaway plan.

If so, you might be required to provide additional information. The audit might postpone any financial debt relief by several weeks. Of course, if the audit transforms up inaccurate info, your situation might be rejected. All that said, these are rather uncommon circumstances. That you made it this far at the same time is a decent sign at the very least a few of your financial obligations are qualified for discharge.

Comments on “3 Simple Techniques For Tulsa Ok Bankruptcy Specialist”